Which Jobs Require Credit Screening?

22nd Apr 2024

Employers across all industry sectors have in recent years started checking more deeply into someone’s background when they apply for a job. Standard checks include looking at factors such as employment history, checking academic qualifications, and criminal record checks also known as DBS checks. One of the less common background checks carried out is into someone’s credit profile, in an attempt to identify people who might pose a financial risk to their business.

If you have a poor credit history or low credit score this can be worrying when you are applying for a job which requires this sort of background screening. Many people with lower credit scores worry about being ruled out from job opportunities or promotions.

Can Employers Check Your Credit Score?

Employers can check a candidate's credit rating only with their permission. Some financial services companies, like legal firms, have to conduct credit checks by law, and other companies may opt to run them on applicants before applying for a job. The requirement for a credit check is usually clearly stated on a job advertisement, which allows you to make the decision about whether to go ahead or not.

Why Do Employers Conduct Credit Checks?

There are many reasons why an employer might carry out a credit check, in addition to it being a legal requirement. A credit check can help confirm the identity of the candidate and flag up any serious financial issues which may affect their ability to do the job or put them in a position vulnerable to corruption or bribery.

Can Bad Credit Result in Job Denial?

Unfortunately, an employer can refuse to hire a candidate with a poor credit history if they believe it could affect job performance or if evidence of poor financial management exists. They do however have to comply with standard rules about discrimination. Most companies don’t make a decision based purely on financial history and will take into account other factors such as experience, performance at interview and the nature of the role they are being employed for. A credit report which is run before deciding whether to employ someone is a soft search and won’t in itself affect someone’s credit score.

Roles Requiring Credit Checks for Employment

There are many different roles and sectors which might require a credit check before employment, but they are more common in some sectors than others. The main industries which typically require credit checking are:

- The Armed Forces: Joining the military involves extensive background checks, including financial ones.

- Accountants and Bookkeepers: Registration with professional bodies such as becoming a Chartered Accountant involves proving a stable financial history.

- Financial Planners: Common practice due to the nature of their work.

- Solicitors and Law Firms: Legal obligation due to the sensitive nature of their roles, and potential access to client funds.

- Police and Law Enforcement: Police forces often check credit histories of potential employees to make sure they don’t have a poor financial state which could leave them open to blackmail or corruption.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

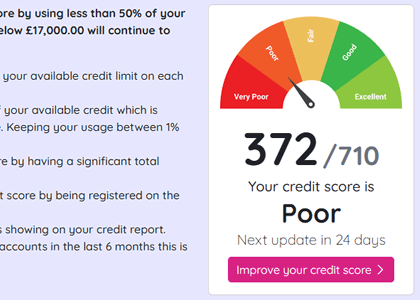

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

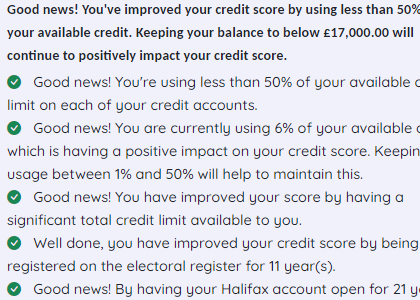

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.