Bad Credit and Car Finance

2nd Jan 2024

Very few of us are in the financial position that we can walk into a car dealership and pay for our new vehicle in cash. Most of us will rely on some form of finance, whether that is organised by the dealer, or arranged through the bank or other financial services provider. If you have a good credit rating then you should have no difficulties in finding a company to lend you the money. If you have recently checked your credit score and found your score isn’t as good as it might be, then getting credit can be much more of a challenge.

While a poor credit rating might pose some challenges to accessing financial products, it doesn't entirely block your path to car ownership. Here is our simple guide to car finance options for individuals with lower credit scores, along with some basics about credit scoring and how to improve your own score with some simple steps.

Know Your Credit Basics

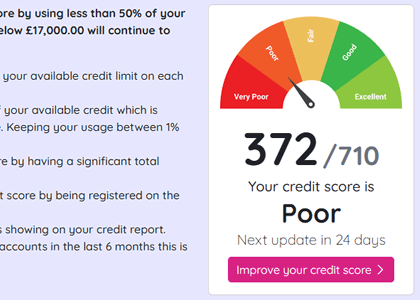

Understanding what credit scoring is, and how it works, is the obvious starting point. Your credit score is just a three-digit number which reflects your borrowing history. The credit referencing agencies work out your credit score from your credit report, looking at issues such as how you make payments, credit searches, total debt, credit availability, and documents such as the electoral register. You can improve your credit score by making regular payments and keeping your borrowing manageable.

Options for Bad Credit Car Finance

Having a lower credit score mean that you have no options at all for getting finance for a new vehicle. Lenders, including car finance providers, will use your credit score to decide whether you are likely to be able to pay back any money which they lend you. While higher credit scores often mean better deals, various finance options, such as hire purchase (HP), personal contract purchase (PCP), and conditional sale (CS), are still available for those with bad credit. However, interest rates may be higher.

Boosting Your Credit Score

Improving your credit score is the most proactive step you can take to get better car finance deals. Check your credit report for any mistakes, get some credit if you have none, and avoid applying for too much new credit. Pay bills on time, keep credit card payments manageable, and register to vote so you can be located on the electoral register. If you have county court judgements (CCJs) on your credit record, then speak to the court which issued them about paying them off. Once cleared, your credit score should start to go up – although it might take a few months for you to see the benefit.

Last Words of Advice

Understanding the process of credit scoring and exploring available finance options can help you find the best deal for your situation when trying to secure finance for a new car. Actively working to improve your credit score can improve the situation so that things are easier next time, giving you a wider range of products to choose from.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.