Latest News

What is a Credit Blacklist

Many people worry that if they've been refused credit or have a poor credit history, they might be on a "credit blacklist." This concern is especially common among those who have missed payments or received a County Court Judgement (CCJ). But a credit blacklist a real thing, or just an urban myth? Another common myth is that lenders have a blanket ban [more...]

Students and Credit Scores

Your financial habits during your student years lay the foundation for your credit footprint, which will follow you into adulthood. This is often the first time you'll encounter bank accounts with overdrafts, student loans, and perhaps even student credit cards. Being responsible with your finances during university sets you up for a strong credit score later in life. [more...]

Cash Advance and Credit Checks

A cash advance involves using your credit card in a cash machine to take out cash rather than using it to pay for items in a shop. While convenient, cash advances can be costly due to additional fees and higher interest rates compared to regular credit card transactions. Appearing to be reliant on cash advances can also have a significant effect on your credit rating. [more...]

What is an Anti Money Laundering Check?

Money laundering is a method used by criminals to make it appear as if the money was earned through legitimate means. Essentially, it's a process of "cleaning" dirty money. In the UK, money laundering is a significant issue, and banks are spending over £5 billion a year to try to stop it. Efforts to stop money laundering affect all of us [more...]

Key Points About a Pre-Employment Credit Check

For many positions in banking and finance companies, a pre-employment credit check is a standard step in the interview process. Other companies may also choose to run credit checks, but many candidates are unsure about the purpose of the process and what it involves. Employers typically look for two things during these checks: Identity Verification [more...]

What Will My Landlord See on a Credit Report?

Landlords will typically do a soft search when you apply for a rental property. Unlike hard searches used by lenders, which focus on your borrowing and repayment history, soft searches only access publicly available information and won’t affect your credit score. Minor issues like occasional missed payments or a lack of credit history generally won't appear in a landlord's search [more...]

Do You Need a High Credit Score to Rent a Home?

While there isn’t a specific credit score number that you’ll need to rent a property, having a good credit score can make the process smoother. A good score indicates a reliable borrowing history, which can reassure landlords that you’re capable of making regular rent payments. [more...]

How Can I Boost My Credit Score Quickly?

Your credit score is the most important single factor in determining whether you can easily get credit, such as a personal loan, car loan, mobile phone contract, or even the best rates for utility bills. Many of the most favourable deals are available only to those who pay their bills automatically by direct debit—a payment option often requiring a good credit score. [more...]

Does an Agreement in Principle Affect Your Credit Score

Congratulations on finding your ideal new home and having an offer accepted! Your next step towards securing a mortgage is applying for an agreement in principle (AIP), also known as a mortgage in principle. This essential piece of documentation is what you can show to the estate agent or seller to that you are a serious buyer and are in the right financial position to go ahead and make the purchase. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

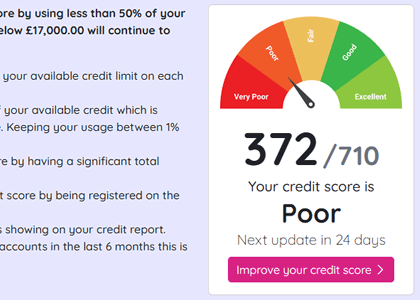

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

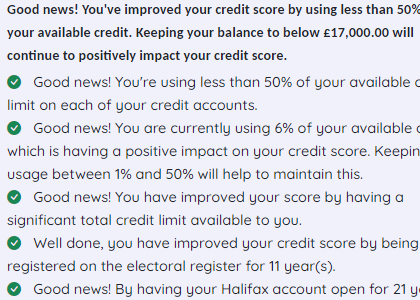

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.