APR and How It Can Affect Your Credit Score

29th Apr 2024

APR, which stands for Annual Percentage Rate, is the annual interest amount paid on borrowed money. When you are considering taking out a credit card or loan, you will be told what the APR on that product is. APR can range from single figures for mortgages and some loans, up to hundreds of percent per year for something like payday loans.

Why does APR matter?

APR is important as it shows the annual interest rate, you're charged for borrowing money. All lending products must display the APR available. However, every time you apply for a loan, credit card or similar product, the lender will look at your credit history and credit score. If your credit score is at the lower end of the people who they will accept, then you might be offered a higher interest rate to offset that risk. It’s then up to you whether you take the credit or not.

Understanding APR on Credit Cards

It is a legal requirement for lenders to state the APR rate on a credit card before you apply. Some credit cards can have a high APR when compared with a mortgage or loan, as these agreements run for a longer period of time. Industry regulations mean that the APR calculation has to be the same for every lender to simplify product comparisons. The APR only matters if you don’t pay your bill in full each month, or plan to withdraw cash using your credit card. Using a credit card responsibly can help you increase your credit score, but running up larger levels of debt by only ever paying the minimum payment can have the opposite effect.

Finding Low APR Options

A credit card is usually not the best option if you need to borrow money and pay it back over a longer period as the interest you will pay is much higher than a loan. When applying for any credit product it is important to shop around, looking at price comparison sites to find out which companies are offering the best deals. Most sites will offer an eligibility check which allows you to enter a few key details and work out your chances of being accepted for the credit if you go ahead and apply. This is known as a “soft credit search” and won’t affect your credit score. If the eligibility check is positive, you can then go ahead and apply for the card, which will mean a hard search which will appear on your credit record.

Repeated Credit Applications

Excessive credit applications can impact credit scores negatively. Applying for lots of difference lines of credit can give the impression that you are in a desperate financial situation. If you get into the habit of monitoring your credit score, you should be aware of which financial products are open to you, and which might be out of reach until you improve your credit score. Manage your existing credit cards by always paying more than the minimum every month to show you are able to manage finances responsibly.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

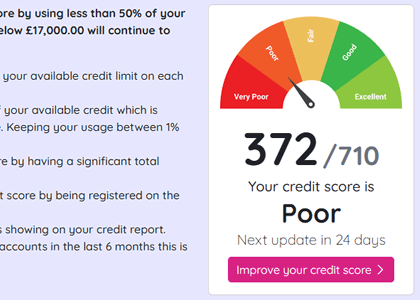

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.