Payment Holidays and Your Credit Report

22nd Jul 2024

A payment holiday offers temporary relief from debt repayments, such as mortgages or credit cards and was big news a few years ago as the Covid 19 pandemic saw many people furloughed on a vastly reduced income. A payment holiday usually means exactly that; a period of a few months where your credit account is put on pause and you don’t have to make any payments. There might also be a second option, to keep making payments but at a reduced rate rather than having to pay the full amount.

Despite the break from making the full payments, you are still obliged to repay the debt, and interest may continue accruing during the pause. At the end of the holiday period, your outstanding balance could be more than it was before taking the holiday, leading to higher future repayments. Taking a payment holiday might affect your credit score too, making it harder to get credit in the future. It’s probably best only to consider a payment option after other alternatives have been discounted.

Reasons for a Taking A Payment Holiday

A payment holiday can offer short term relief for people facing temporary financial challenges due to:

- Redundancy

- Reduced working hours

- Maternity or paternity leave

- Unexpected household or car expenses

Getting a Payment Holiday Agreed

Each lender will have its own rules about eligibility for payment holidays. Decisions are typically made promptly based on individual circumstances. If you have been a model customer up to the point at which you request a payment holiday, you stand a better chance of having a payment holiday agreed. Don’t ever just decide to take a payment holiday and stop making payments without getting agreement from your lender first.

Impact of a Payment Holiday on Credit Score

While a negotiated payment holiday isn't recorded as a missed payment, it generally appears on credit reports, and could potentially affect your credit score. The credit report won’t record the reason for taking the payment holiday, and other lenders won’t be aware of your full circumstances.

Once the payment holiday term is over, the mortgage lender might recalculate your monthly payments, spreading deferred payments over the remaining term or extending the mortgage term. This might mean that your monthly payment goes up when you start paying again. Make sure that any direct debits are set up to make payments again so that you are not hit with missing payment penalties too.

Alternatives To Payment Holidays

While payment holidays offer short-term relief, they're not always the most suitable solution for long-term financial issues. It’s usually best to try to renegotiate repayment terms or move the borrowing with a deal with a lower interest rate. Always speak to your lender about any issues you are having before your finances get to crisis point.

Although payment holidays can provide breathing room during short periods of financial stress, think carefully about the long-term implications of a payment holiday, and make sure you’ve considered other options before signing up.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

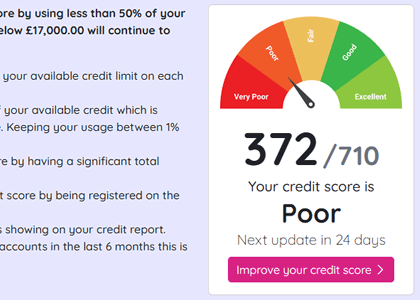

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

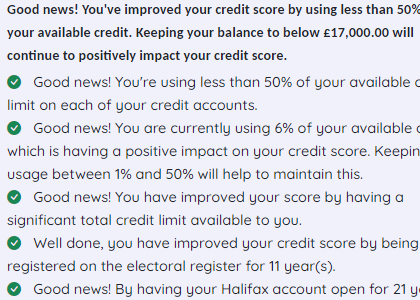

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.