How Your Overdraft Affects Your Credit Score

10th Jun 2024

One of the most commonly used form of credit is the overdraft, even if you don’t class it in the same category as other forms of credit. Although January is the month in the year which sees the peak of financial pressure for most, for many people trying to balance the books in a time of rising prices there is no month of the year which sees less financial stress. Many of us resort to using overdrafts until their next payday, but could this have a negative impact on your credit score?

An overdraft is a form of borrowing through your standard bank current account, and like any other form of borrowing, it needs to be paid back. An account goes into overdraft when a transaction is paid by the bank even when you don’t have sufficient funds in the account.

Types of Overdraft

There are two main types of overdraft on your current account. An authorised overdraft is agreed in advance with the bank and allows you to spend up to whatever overdraft limit you have agreed with the lender. On the other hand, and unauthorised overdraft is when you spend more than you have agreed with the bank as a limit. Unauthorised overdrafts are expensive, and you will be hit by charges and fees which make this an expensive form of borrowing. The interest on overdrafts can be anything between 19% and 40%. It’s an expensive way to borrow money and you’ll want to be able to pay back your overdraft as quickly as possible.

Impact of Overdraft on Your Credit Score

Just having access to an overdraft usually doesn't influence a credit score. Depending on how you use it, your overdraft can positively or negatively affect your credit score.

If you are asked to repay an overdraft by your lender and fail to do so, then this will reflect negatively on your credit score. Similarly, if you regularly go beyond the overdraft limits set by the bank, this will be seen very negatively as it is an indication that you are struggling to manage your day-to-day finances.

Checking Your Credit Score

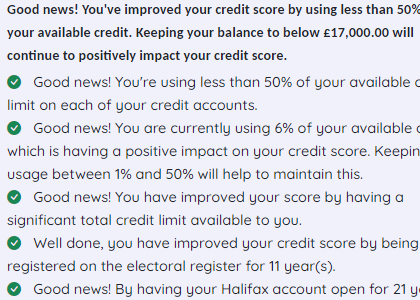

It’s easier than ever to check your credit score by logging into one of the many websites and apps which are set up to allow you to do just that. It’s usually best to log into the site or app about once a month, as that allows you to track the progress of your credit score over time. Minor changes up or down are nothing to worry about, but dramatic changes in the score should be investigated as it could indicate that you have become the victim of identity fraud or similar.

Once you have been tracking changes in your credit score for several months, you should be able to see whether actions you are taking have a positive or negative effect. There is lots of guidance online about steps which you can take which will help you build your credit score, however low the starting point.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

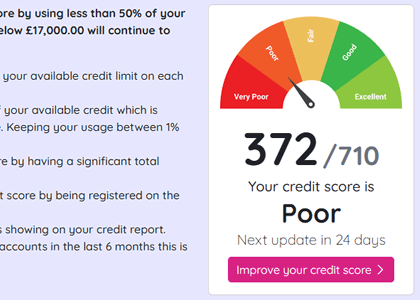

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.