All About CCJs

3rd Jun 2024

If you owe money to a company and a court has ruled that you must repay it, you may have a County Court Judgment (CCJ) against you. Having a CCJ can negatively affect your credit rating, making it difficult to get credit or borrow money from banks or get hire purchase finance on a new sofa or car. A CCJ will be listed on your credit report, which is information provided by a credit reference agency to any company which you have applied to borrow money from. The credit report and your credit score will be used to decide whether the company wants to have you as a customer or not.

How to Check Whether You Have a CCJ

Most people will know whether or not they have a CCJ against them. These are only issued after ither ways of getting you to pay the money back have been tried, so will come after several reminder letters from the people you owe money to, and from the court. If you’ve moved house frequently, or have been overseas, it is possible that you may have missed all the correspondence.

There are two main ways of working out if a CCJ has been issued against you:

- Search the Register of Judgments, Orders, and Fines: this is the official register kept by the court service listing people who have had a CCJ against them. Access the Register online pay the £10 fee to see what information is held about you.

- Get a Copy of Your Credit Report: Ask for a free copy of your credit report from a credit reference agency. This report will list any CCJs which are held against you.

Removing a CCJ

If a CCJ is over 6 years old, it will no longer appear on the Register, regardless of whether it has been paid. Before that time expires, you can apply to get the CCJ removed if you can prove to the court that you do not owe the debt. If you pay off the CCJ in full within a month of it being listed by the court, then it will also be removed.

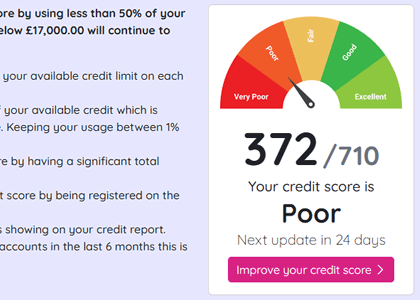

Effects of CCJs on Credit Score

If you have received a credit score, this will be reflected in your credit score, making it harder for you to get a new loan, mortgage, or credit card. A CCJ is a strong indication to lenders that you have had financial problems in the past, so much so that the matter has been dealt with through the courts. Lenders will treat this very negatively as they will think that there is a high risk of you not paying back money they give you either.

The best advice if you have a CCJ on your file is to take steps to pay off the debt. Clear it as soon as you can and check your credit score to make sure it disappears. It may take some time for your credit score to recover, so keep managing your finances responsibly, and track changes in your credit score online.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.