Getting a Loan Without a Credit Check

12th Aug 2024

Being able to get a loan without going through a credit check might seem like an appealing option, especially if your credit score is less than perfect. However, at least in the UK, lenders will almost always ask for a credit check before approving any loan application. If you have been searching online you might have come across adverts for no credit check loans, often marketed to individuals with poor credit ratings, but these are not usually available from UK lenders.

Choose Your Loan Products Carefully

Although it might initially seem like a good idea to look for quick loans without credit checks, it's important to approach such offers with caution. Remember that most loans which are available without credit checks are designed for people who struggle to get credit from more conventional lender. Loans often come with high interest rates and strict repayment terms. They will cost more in the long run, and you may be hit with much higher monthly payments. Lenders offering these high interest, no credit check loans may not be regulated by the Financial Conduct Authority, which means you have few consumer rights.

Alternatives to No Credit Check Loans

Instead of looking for loans which you can get without credit checks, consider alternatives such as credit unions. A credit union is a not-for-profit organisation which provides financial products to eligible members. As the credit union is not paying dividends and profits to shareholders, they generally offer lower interest rates on loans than the big banks, but the downside is that you might not be able to borrow quite as much money either. Credit unions are more likely to consider your own circumstances when making a lending decision, rather than relying on a computer to make the decision.

Hard and Soft Credit Checks

Understanding the difference between hard and soft credit checks is also important when you are shopping around for loans and thinking about how it might impact on your overall credit score. A hard credit check is one which is carried out at the point of applying for any for form of credit, including a loan. Hard credit checks leave a mark on your credit file, and applying for a lot of credit in a relatively short period of time can adversely affect your credit score. On the other hand, a soft credit check, which does not affect your credit score, can be used for pre-approval processes or eligibility assessments. This is the sort of check which is involved when using an eligibility tool, or a website which assesses your chances of being approved if you go ahead and make a firm application.

In summary, while the appeal of loans without credit checks may be strong, it's essential to consider the risks. Often, there are other, better regulated options which can allow you to access credit at competitive prices, and without the risks. Responsible borrowing can also boost your credit score so that next time, you have a wider choice of credit products available to you.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

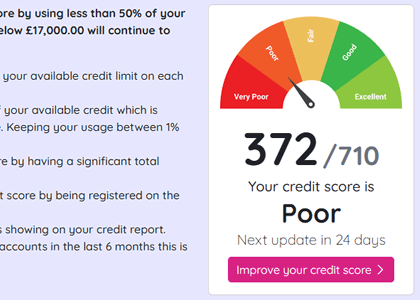

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

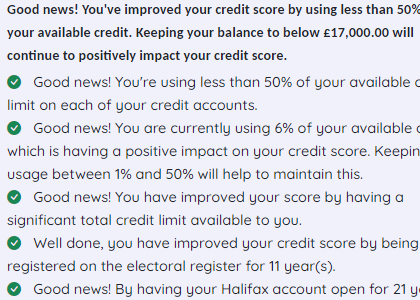

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.