Credit Checks and Tenant Referencing

5th Aug 2024

From a landlord’s point of view, your rental property likely represents a significant financial asset. They want to make sure they do everything possible to safeguard it and maintain its value. One of the main ways in which they do this is with tenant referencing.

Tenant referencing isn’t just a vital safeguard, it also provides peace of mind to landlords and reassures tenants that they are dealing with a professional landlord. Spending some time before a tenancy starts to check out the backgrounds of renters, taking up references and looking at their credit record minimises the chances of the tenancy running into trouble further along the line.

How the Tenant Referencing Process Works

Each landlord and letting agency will have a slightly different way of managing their tenant referencing. However, there are some elements of the process which are common to most situations. If you are thinking of moving into privately rented accommodation in the near future, you can expect to be asked to provide:

- Proof of Identity: usually two forms of identification, including photo ID such as passport or driving licence, and proof of residency such as bank statements, or utility bills.

- Credit Check: Assessment of your credit history to make sure you have no County Court Judgements (CCJs) or bankruptcy orders against you. Any history of financial instability might raise alarms for the landlord.

- Previous Housing Reference: Reference from a previous landlord or letting agent to prove you’ve paid the rent on time and looked after the property.

- Employment References: To confirm that you have a regular income and can easily cover the rent.

- Right to Rent: This is a government check to make sure you are living in the UK legally. Tenants will be asked to show their passport to prove nationality and any visa restrictions they may be under.

Tenant Referencing Challenges

In some situations, clients face challenges meeting referencing criteria, perhaps because they are students without full time employment, or have only recently arrived in the UK. Sometimes, alternative arrangements can be made. Options may include providing a guarantor or paying rent in advance. If however, you fail the right to rent checks because you cannot prove you are in the UK legally, no reputable landlord will rent to you.

Understanding Guarantors

Guarantors undertake responsibility for rent payment or property damage compensation on behalf of tenants if the tenants can’t afford the rent or leave the property in disrepair. Guarantors have to undergo similar referencing checks to tenants and sign a contract to make sure they understand their legal responsibilities.

Any individual over 21 years with a solid credit history, financial stability, UK residency, and ideally homeownership can be nominated as a guarantor, but in most cases, the guarantor is a close family member or friend of the person who will be renting the property. Being asked to act as a guarantor is not something which should be considered lightly, as you might have to step up and pay the rent if the tenant cannot.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

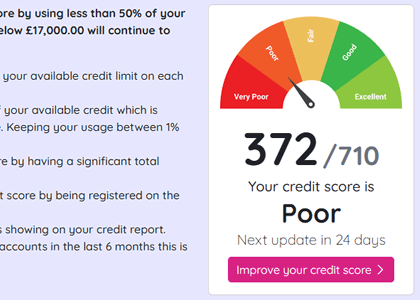

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

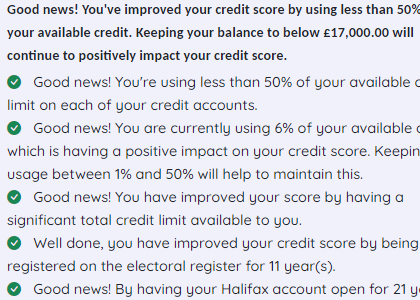

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.