Can You Use a Credit Card Without Damaging Your Credit Score?

22nd Jan 2024

A recent survey by a leading British financial services website has revealed that nearly two-thirds of us don’t really understand how credit card usage can affect our credit scores. January is a time when money is tight for many after the festive season, forcing many of us to reply on credit cards to get through the month. But will depending on a credit card, or even using one for most of your day to day spend affect your credit score? Here we’ll explain how your credit report works, and how your credit card use can affect the numbers – either positively or negatively.

Spend Within Your Means

Your credit limit on a credit card limits the maximum amount you can spend. It's important to spend only what you can comfortably repay each month as this will prove to the lender that you can manage your credit effectively. If you are using a zero percent deal or other promotional offer, match your spending with your ability to repay to avoid racking up any interest charges.

Never Miss a Repayment

Missing a credit card repayment can have lasting effects on your credit score, and the impact can limit future borrowing capabilities for up to six years. Set up a direct debit to cover at least the minimum monthly payment, to guarantee you never miss any deadlines. This proactive approach is an easy way of protecting your credit score.

Pay More Than the Minimum

While clearing your credit card balance in full monthly is ideal, always aim to pay more than the minimum required. If a lender sees that you are only ever paying the minimum, they might suspect that you are struggling. By paying more each month, you will clear the balance more quickly, reduce overall interest payments, and show them that you can be trusted to manage accounts responsibly.

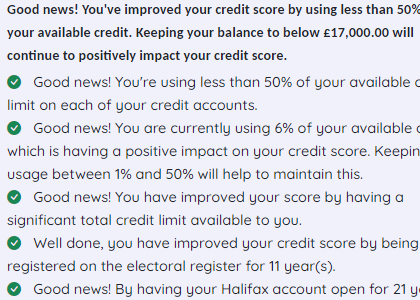

Think About Credit Utilisation

This ratio is about the proportion of available credit you're using. If you have more credit available to you than you are using, this is seen positively by lenders. Calculate your ratio by dividing your current outstanding balance by your total credit limit.

Avoid Cash Withdrawals

Steer clear of withdrawing cash on your credit card unless you have an overseas card designed for this purpose. Credit card providers often charge higher interest rates on cash advances, so it is an expensive borrowing option.

Using a credit card wisely is one of the most important things you can do to maintain a healthy credit score. Using your credit card carefully and paying off as much of the balance as you can each month will prove to lenders that you are a good risk, and that responsible attitude should be reflected in your credit score. It may take several months to see your behaviour reflected in your credit score numbers. Keep the effort up, and next time you apply for a credit card you will be in a much better situation to secure a good deal.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

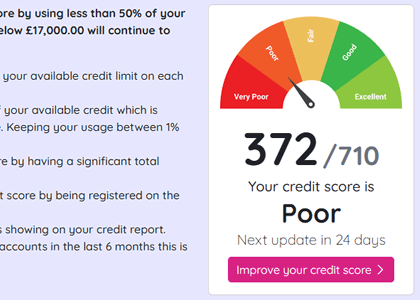

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.