5 Most Common Credit Score Mistakes

29th Jan 2024

If your mission for 2024 is to improve your credit score, it can seem like a huge mountain to climb. There is also lots of conflicting information about what steps you can take to improve your credit score, with some reputable sites giving great advice, whereas others offer advice which is less effective. If you have logged into your credit report recently and seen that your credit score could be better, then we can help you avoid the main mistakes which people make when trying to improve matters. Having a better than average credit score puts you in a better position to access competitive interest rates from a wider range of lenders than people who have poorer credit scores.

Using Too Much Available Credit

Thinking about your credit limit as 'free money' is a common mistake. Responsible credit management involves trying to limit the percentage of your available credit which you are using ideally to around 30%. Being at or very near your credit limit at all times might signal to lenders that you are in financially difficulties, and this can make it difficult to get another loan or credit card.

Ignoring Credit Report Mistakes

Your credit score is calculated based on information in your credit report, and if there is inaccurate information in your credit report then this will be reflected in the numbers. Overlooking mistakes, such as accounts incorrectly marked as open when you have closed them can have a knock-on effect on your credit score. Checking your credit report is free of charge, and doing this regularly will help you spot any errors before they start to have an impact on your credit score.

Not Being on the Electoral Register

Being registered as a voter on the electoral roll provides credit reference agencies with proof of identity, and proof of where you live. The first step in any credit checking process is this identity verification, and you may fail at the very first hurdle if you are not registered to vote. There is no charge to registering, and you can do it online.

Excessive Credit Applications

Each credit application which you complete triggers a hard search on your credit report, and too many of these in a short time can have an adverse effect on your credit report. Making multiple applications in a short timeframe may indicate desperation for credit, potentially deterring lenders. If you are rejected for a loan or credit card, don’t immediately rush to another site to look for another offer to apply for.

Late Payments

Missing bill payments, or even being consistently late in making loan or credit card repayments results in negative marks on your credit report. A good way of avoiding this is setting up direct debits to pay off your credit card or loan payment each month so that you do not have to proactively remember to transfer the money.

Avoiding these five common mistakes will maximise your chances of maintaining a healthy credit report, which in turn maximises your chances of successful credit applications in the future.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

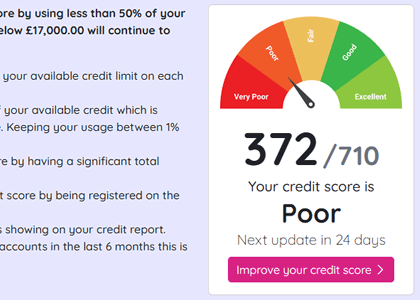

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.