Quick Ways to Improve Your Credit Score

1st Oct 2024

If you’re facing high interest rates when you take out a new loan or credit card, or rejection due to poor credit scores, then you’re one of many millions with the same problem. Whether you're looking to get a mobile phone contract, a credit card, or a mortgage, having a good credit history is a key step in getting approved in the first place, and securing the best interest rates.

Impact of Poor Credit Ratings

When you apply for a new credit card or loan, lenders conduct a "hard" credit search to decide whether you are likely to pay them back. If they reject you, this can further impact your credit score. Even if you are approved, studies show that only 51% of successful applicants get the advertised interest rates. Many customers are forced to settle for higher interest rates or lower credit limits than they wanted. Recent credit industry data shows that 31% of loan applications were refused, and many millions of adults avoid applying for credit due to fear of rejection.

How to Build and Improve Your Credit Score

The good news is that over time, there is lots you can do to improve your credit score. Building up your credit score isn’t a quick fix, but over a longer period you could consider the following steps to boost your numbers.

- Get Credit - Having no credit history can also be a drawback as the lenders don’t have a track record to judge you on. Using credit-builder cards or even a mobile phone contract can help show them you can be trusted. These cards typically have lower limits and higher interest rates, but paying them off monthly can improve your score within four to six months.

- Get Organised - It's very important never to borrow beyond your means, as missed payments will massively affect any credit score.

- Get Registered to Vote – One of the most important things to do is to register to vote, confirming your presence at your home address. This one thing can instantly raise your credit score by 50 points or more.

- Don’t Apply for Too Much – lenders may think that you are in financial distress if you start applying for too much credit too quickly.

Making the Most of Soft Applications

When you apply for credit, lenders can only use the information from your application and credit report to decide. Every application leaves a mark on your credit report, which can affect future applications as lenders may worry you are applying for too much. Using an eligibility calculator, which are available on many lenders’ websites, allows you to check your chances without impacting your score. These calculators perform a "soft" search that doesn't affect your credit score but gives you an idea of your eligibility for various financial products. If you find through a soft search that you are more than likely to be accepted for credit, then you can go ahead and apply with more certainty, and without a negative impact on your credit score.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

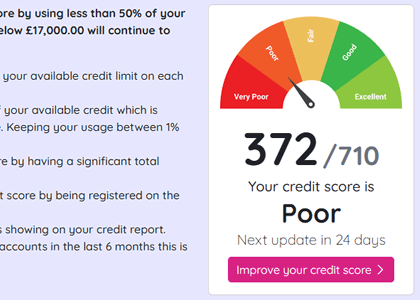

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.