How To Protect Your Credit Score

13th May 2024

If you’ve already checked your credit score and found that you are scoring better than average, then it is easy to take your eye off the ball and assume that you have nothing to worry about. However, credit scores can go up as well as down, and just because you have a great credit score now, it doesn’t mean that it will remain that way in the future. If you're aiming to boost your credit score, you're not alone, and there are numerous steps you can take to achieve this goal.

Your credit score is a numeric representation of your creditworthiness and financial history and is calculated by the main credit referencing agencies in the UK. Lenders and credit card companies look at your credit score as a way to assess whether you are likely to repay any money they lend you. A higher credit score increases your chances of getting loans and credit cards with good interest rates.

If you want to protect and maintain a good credit rating, or improve a credit rating which has slipped, there are six key things you can do which will be positive for your credit score.

1. Timely Payment of Credit Card Bills

Perhaps the most important things you can do to improve your credit score is to ensure timely and complete payment of bills each month. This demonstrates your reliability as a borrower and shows lenders that you are the sort of potential customer who can be trusted.

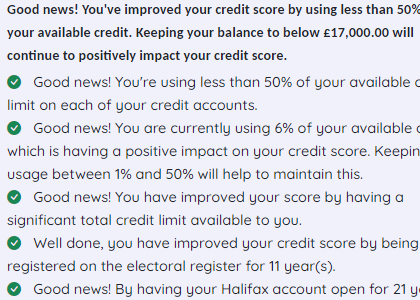

2. Keep Your Credit Card Use Low

Credit utilisation is about looking at the proportion of credit you are using, relative to your available limit. Lenders like to see lower use ratios, typically advising consumers to aim for 0-30%. Not using all of your available credit shows them that you are not struggling financially and have no problems in managing your expenses.

3. Check Your Credit Report for Accuracy

Even minor mistakes in your credit file, such as incorrect address details, can adversely affect your credit score and influence credit decisions. Regularly looking at your credit report allows you to spot errors quickly, removing anything which could count against you.

4. Don’t Move Around and Register to Vote

A stable address history is important for your credit score, as frequent changes of address may raise questions about lifestyle stability. Registering to vote at your home address will also improve your credit rating and is free to do.

5. Keep Older Credit Card Accounts

Don’t be tempted to close old credit card accounts which you are no longer using. Having available credit which you are not fully using will reflect positively, as will a long history as a customer with the same lender.

6. Use Eligibility Checks

Being rejected for credit may negatively impact your credit score, especially when you are turned down many times in a short period. Instead, use eligibility checkers to work out whether you are likely to be accepted before going ahead and making a firm application.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

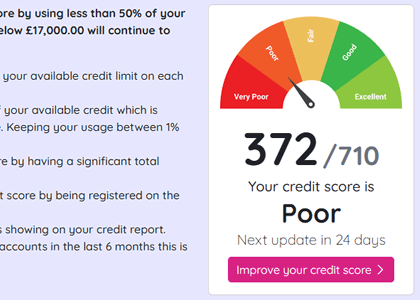

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.