Does Checking Your Credit Score Make it Worse?

19th Feb 2024

The internet has made it easier than ever for members of the public to check their credit score. It takes seconds to log into a website or tap on an app on your smartphone and look at the information which lenders will see about you. Logging in to look at your credit score is considered a soft inquiry and does not have any impact on your overall rating.

Understanding Soft Inquiries

Soft enquiries or soft credit checks can happen in a range of ways. Checking your own credit score through an app or website counts as a soft check and will not damage your credit score. Similarly, if you fill in a form online to check your eligibility for a loan or credit card, or go through some sort of pre-approval screening, this will not have an impact on your score either. This is because neither of these scenarios are classed as an application for credit. Allowing a potential landlord or employer to run a credit check on you is also a soft search.

Once you progress to the firm application stage, that becomes a hard search on your credit file. Too many hard searches over a short period of time can negatively affect your credit score. This is why it is important to use soft searches to make sure you are only applying for credit you’re sure about getting.

Factors Impacting Your Credit Score

There are lots of different factors which might affect your credit score, and each credit referencing agency will put different importance on each. Some of the main factors which will affect your credit score are:

- Payment history – if you regularly pay in full, on time, this will have a positive effect on your credit score and in contrast, a history of late or missed payments will damage it.

- Length of history – having a long history lets credit lenders track your behaviour over several years. Chopping and changing accounts and credit cards often may reduce your score.

- Mix of credit – lenders like to see people with range of different products such as mortgage, credit cards or personal loan, rather than people who just rely on a single form of credit such as payday loans.

- New credit – taking out a new form of credit such as a mortgage or loan will see your credit score dip for a few months, then recover. Repeatedly applying for new credit in a short period of time can dramatically lower your credit score.

Tips for Credit Improvement

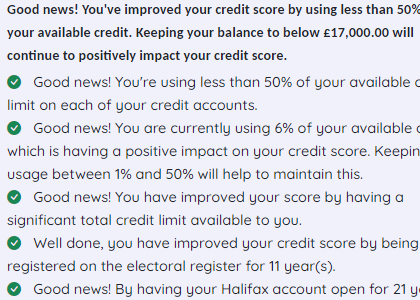

Regularly checking your credit score is vital, especially if you are trying to rebuild your credit history. Improve your score by switching your regular payments to direct debit so you won’t forget to pay, try to keep the balances on your credit cards low rather than near the limit, and only apply for new lines of credit when you really need them. It may take six months to a year to see the results of your hard work.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

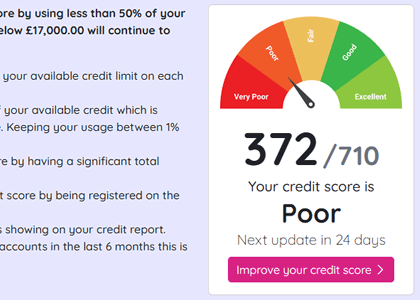

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.