Building Your Credit History

11th Mar 2024

Having a good credit record significantly influences someone’s ability to secure loans, mortgages, bank accounts, phone contracts, and credit cards. One of the most common problems for younger people, or for those who have recently moved to the UK, is how to get that first loan or credit card with no financial history to draw upon in your credit report. If your situation is that the credit reference agencies just don’t have enough information about you to base a decision on, here are some easy steps to take in order to start building your credit history.

How Credit Scoring Works

Credit scoring relies on predicting how someone is going to manage their credit in the future, based on past behaviour. Having no credit history may lead to rejection for loans, mortgages, or other financial products simply because the lender can’t tell whether you’re a good risk or bad risk.

Get Registered to Vote

The first thing that you should do is register to vote. This is because one of the first things that any lender does is to verify your identity, by checking that you live where you say you do. If you are not on the voters’ lists, your application will fail at the first hurdle. There is no charge for being registered to vote, and you can do it online.

Student Bank Accounts

Students are one of the main groups who find problems with getting credit, and many banks offer special student accounts which are designed to help them start to build their credit profile. Having access to an interest-free overdraft facility, and using it responsibly, can help build up your credit score.

Eligibility Calculators

An eligibility calculator lets you know your chances of being approved for credit before going ahead and making a firm application. This is known as a soft search and has no effect on your credit score. If you apply for credit and have it refused, then this can affect your rating, especially if you apply for several lines of credit in a short period of time as lenders might interpret this as financial desperation.

Checking Your Credit Rating

There is no charge for checking your credit report and no penalty on your credit report for checking as often as you wish. Checking monthly is a good habit as this will let you track the progress of your credit score. It is also important to look for any mistakes on your credit file and ask lenders to put right any errors you find. Think of building your credit score as a long-term project.

Avoid Pay Day Loans

Payday loans and other forms of very short-term credit which come at high interest rates should be avoided at all costs. Lenders know that people only take out payday loans when they have no other option for loans or credit, as they are so expensive. Seeing payday loans on your credit report, even if you are paying them back, will raise worries about your financial management.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

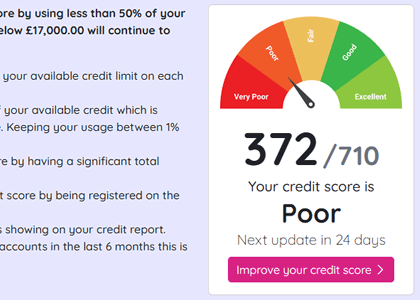

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

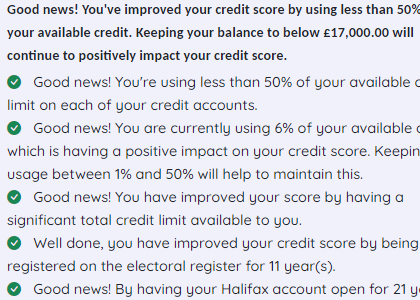

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.